The Rocket Pool Protocol

Analysis of Rocket Pool including a performance simulation and a PnL investigation.

Part 1 - How it Works

Introduction

In the realm of Ethereum investment, many users lack sufficient ETH funds to initiate their own validator, as 32 ETH is required. However, liquid staking offers ETH investors an opportunity to access validator staking rewards by allowing them to delegate their ETH to a staking service provider. In exchange, the staking service provider issues a token that represents their stake. This token can then be used to participate in decentralized finance (DeFi). The two largest platforms offering this delegation capability are LIDO and Rocket Pool.

Operating an independent validator can be a technically challenging endeavor. For those interested, Rocket Pool provides a solution that enables the creation of a validator using a combination of personal funds and funds borrowed from the deposits made by liquid stakers. Rocket Pool offers an excellent integrated development environment (IDE) to assist with validator setup and provides comprehensive documentation.

Part 1 of this post covers how liquid stakers earn rewards, the differences between Rocket Pool and LIDO, and the key aspects of operating a Rocket Pool validator.

The Rocket Pool Innovation

Rocket Pool entered the Ethereum landscape in 2017, with its public launch on the Mainnet occurring on November 9, 2021. Since then, the project has grown continuously and now has approximately 850,000 staked ETH distributed across around 3,500 node operators running validators.

LIDO allows only pre-approved companies, rigorously vetted for competence and capability, to participate in validating. In contrast, Rocket Pool innovatively encourages a broader range of entities to run validators, thereby increasing participation in securing the network.

Rocket Pool expanded the pool of potential validator operators by enabling node operators to combine their ETH with funds from liquid stakers to create validators, significantly reducing the initial investment by 75%.

Rocket Pool developed a protocol that allows anyone capable of running a validator to do so in a trustless manner. The system rewards node operators for effective validation and, through the requirement to post collateral, establishes safety buffers to protect public ETH and ensure its safe return.

Accessing the Staking APR

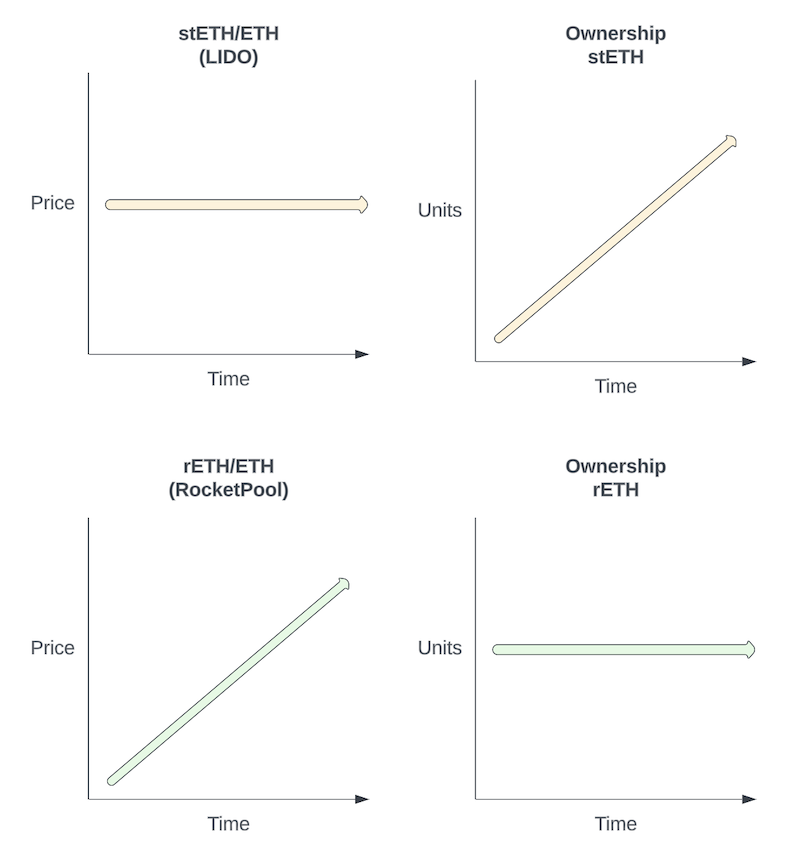

LIDO stakers go to a page, deposit ETH from their wallet, receive stETH back and earn additional stETH representing the rewards from staking. This is implemented using a re-basing/shares mechanism. Rocket Pool converts ETH into rETH, but instead of receiving additional rETH from staking, the value of rETH increases as rewards are earned.

Figure 1

Figure 1

LIDO

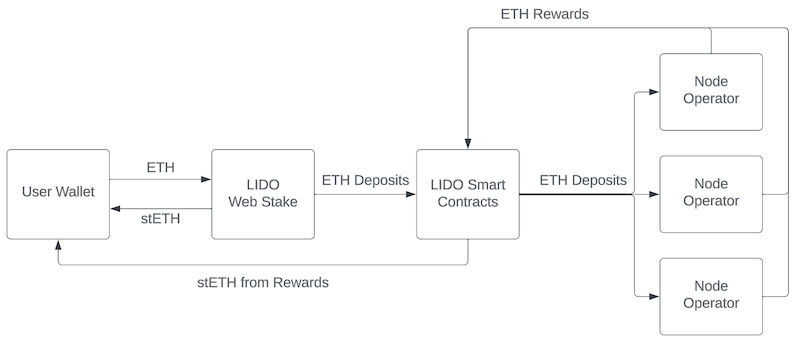

LIDO works in conjunction with known staking companies who gather up deposits and amalgamate them to create validators on behalf of LIDO from user funds. LIDO takes 10% of the staking rewards and distributes 90% back to the users.

The 10% is split between LIDO and the staking companies providing validation infrastructure and services to ensure staker ETH participates safely and consistently in the activities of the Beacon Chain. Validating accurately and responsively is crucial to avoid slashing events.

Stakers accumulate additional stETH shares daily as rewards are earned and are able to redeem back to ETH (large amounts may incur a waiting period) on LIDO through their web3 interface. stETH is a “liquid staking token” (LST) which can be used to participate in decentralised finance protocols. LST’s give users the ability to re-use their ETH for a second activity in the ecosystem while it is delegated.

Figure 2

Figure 2

Rocket Pool

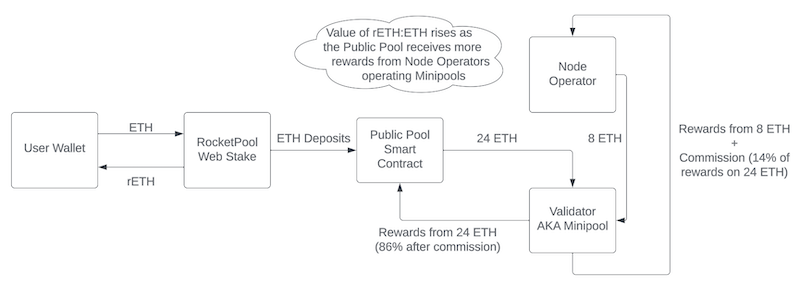

Rocket Pool employs a similar mechanism to LIDO but with some important differences. For users, the process mirrors that of LIDO: they can visit Rocket Pool’s website and exchange their ETH for rETH (a liquid staking token that can be utilized across the ecosystem).

The user’s ETH is transferred to a “public pool,” where it is amalgamated with other user deposits. Validators are then created by node operators using a combination of funds from the public pool and their own funds.

Rocket Pool’s smart contracts ensure that ETH from the public pool receives its share of rewards and is always safely returned to the pool if a validator or node operator ceases to perform its duties. Additionally, Rocket Pool provides extra protection for user ETH by requiring node operators to post collateral against the ETH they borrow from the public pool.

Figure 3

Figure 3

Running A Rocket Pool Node

For node operators, the 32 ETH required for the validator comes from both the node operator’s funds and the public pool, allowing a node operator to create a validator with 8 ETH of their own and by borrowing 24 ETH. Node operators receive a commission for performing validation on behalf of the public ETH.

Getting Started

To get started and build a Rocket Pool validator, you need 4 things:

-

The ability to build & operate the infrastructure required for validation.

-

8 ETH - at the current price of 3380 USD (as of 29 Feb 24) this is 27,040 USD.

-

2.4 ETH (10% of the ETH that will be borrowed from the public pool) in RPL (Rocket Pool token). RPL currently trades at 31.7 USD (as of 29 Feb 24) so approximately 256 RPL.

-

User funds in the deposit pool. As of writing, the pool is currently full (18,000 ETH). The pool can be checked on RocketScan.io.

The RPL is posted as collateral to borrow the 24 ETH from the public pool to create a validator. In Rocket Pool parlance, this is known as a Minipool. RPL is a standard ERC 20 token.

Node operators may also choose to create a Minipool with an initial investment of 16 ETH. This reduces the amount of borrowed ETH which in turn reduces the exposure to the RPL token.

The RPL is sent to the Rocket Pool staking contract and earns rewards of ~7%. See what-can-i-earn for the current rate.

In order to earn RPL rewards, the collateral must be kept at 10% (or more) of the borrowed amount so it is essential to keep an eye on the RPL/ETH exchange rate. The network pays rewards every 28 days and when rewards are calculated, the collateral ratio is checked as well as how long the Minipool has been active during the period.

Smartnode IDE

Rocket Pool’s Smartnode stack allows an operator to get up and running with ease. Providing you have the financial resources detailed above, the software and documentation are excellent and abstract a lot of the hard work from operating.

As a node operator, you need to be comfortable with maintaining an Ethereum node, but everything else that is required to extend a validation infrastructure to include Rocket Pool is handled by the Smartnode stack.

Financial Benefits

Rocket Pool’s smart contracts ensure that a node operator gets paid a commission for performing validation duties on behalf of borrowed ETH. The commission is currently 14%. The below illustrates how this provides a financial uplift.

Using a composite APR of 5% for all network rewards:

- 8 ETH * 5% = 0.4 ETH

- 24 ETH * 5% * 14% = 0.168 ETH

- On 8 ETH you earn 0.568 ETH

This is a 42% uplift on rewards. Instead of earning 5% you are earning 7.1%

(Note: This example does not include fees if a 3rd party operates your Rocket Pool validators)

This is a simple example and it is important to also consider the fees that must be paid to set up and administer a node. Calls to smart contracts can be expensive, particularly when demand on the network is high.

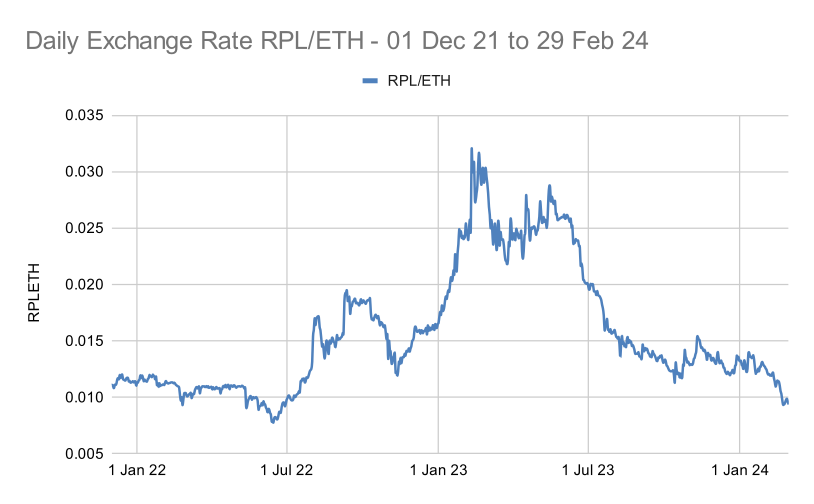

The most significant input to performance is the price fluctuations in RPL/ETH (Units of RPL to 1 unit of ETH) and this is explored in depth in part two of this post.

Summary

-

If you are capable of running an Ethereum node and you have the appropriate financial resources; 8 ETH per Minipool, 2.4 ETH worth of RPL and some additional ETH for the gas required to initiate the node and create the Minipool, Rocket Pool warrants a closer look.

-

Rocket Pool has over 2 years of live operation and ~ $4bn in value locked across ~3,500 node operators. It is an innovative approach for ETH holders to stake at home and create a validator with ¼ the standard ETH required, or to add leverage to a position by running more validators with the same initial deposit and collecting commissions.

-

The next part of the post details a financial back-test and covers how an investment in Rocket Pool would have performed since live, taking into account fees, commissions and staking rewards.

Part 2 - Rocket Pool Performance

Introduction

Creating a Rocket Pool node, initiating Minipools, posting collateral, and claiming rewards all incur costs associated with making calls to various smart contracts. The majority of the expense occurs during initialization, but it is also important to consider the recurring costs over the operational lifespan.

Part 2 of this post delves into the mechanics of Rocket Pool and evaluates how an investment would have performed, taking into account commissions, fees, and token volatility.

The predominant factor influencing profit and loss (PnL) is the performance of RPL, unless you can borrow it. As a node operator, you are effectively long on RPL/ETH.

Setup Costs & Fees

There are two types of fees involved; one-off (register a node, create a Minipool) and regular (distributing or claiming rewards).

The creation of each new Minipool is expensive (~0.16 ETH for 4 pools including the cost of initialising the node address) because the protocol creates a new smart contract with all the methods that the Minipool will need to operate. Read about megapools to see how the Rocket Pool team plans to make setup cheaper in a forthcoming release.

During operation, the Minipool will receive income from validation as well as transaction fees (tips) and MEV (maximal extractable value).

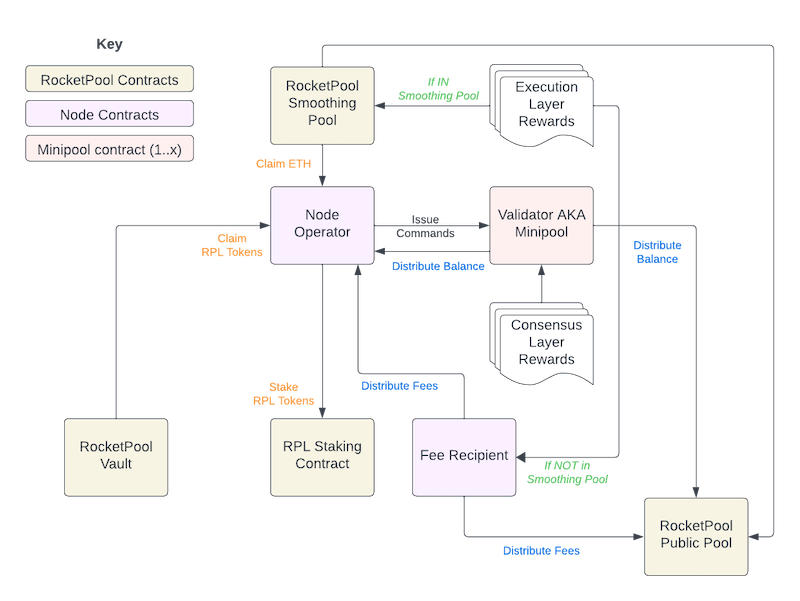

Fee Distribution

All ETH generated by the Minipool needs to be fairly distributed between the node operator and the public pool. This process is done by calling operations using the SmartNode IDE or, for advanced users, through direct calls to Rocket Pool smart contracts.

There are two options for managing execution layer fees (MEV and Tips) with Rocket Pool:

Option 1:

Run the fee distributor contract that the protocol creates when the Node is initialised and make sure all validators point to this address. When the distribute fees method is called, the contract will ensure that the public and node operator payments are dispersed in accordance with the commission rate.

Option 2:

Opt in to Rocket Pool’s smoothing pool. If running a small set of Minipools then the smoothing pool is an option worth researching. You relinquish the right to claim MEV proceeds at the node level but you are pooled with a much larger set of validators who have a higher chance of winning blocks.

Node Operation

Figure 4

Figure 4

Duties

Node operators must call distribute balance on each of the Minipools to ensure money due to the node and the public pool is dispersed. Balances will accrue on each Minipool between distribution events.

If using the created Fee Recipient contract and handling the MEV setup, it is necessary to periodically call the distribute fees method. If using the Smoothing Pool, all rewards due to the node operator are claimed by calling a method on a central contract and the ETH, as well as any RPL interest from staking, are paid as part of this process.

These are all smart contract calls that have a gas cost associated with them.

The duty of a node operator is to keep their system operational and healthy and this is covered extensively in the Rocket Pool documentation.

Backtest

The backtest is run with 3 different scenarios:

- Post 10% collateral; the minimum required amount

- Post 12% collateral; ensures collateral is 10% (or more) at all observation points

- No collateral; assumes the RPL is borrowed and the lender claims all rewards

The backtest is accessible in Google Sheets

Assumptions

- A Rocket Pool Minipool requires 8 ETH. Assumes 32 ETH which is 4 Minipools. This is to simulate differences between a standard Beacon Chain (Vanilla) validator & Rocket Pool.

- Assumes a call to

distribute balanceevery 90 days. - Includes fees for initialisation of the node and Minipools,

claim and stakeanddistribute balancetransactions. - Assumes a 5% staking annual return.

- Assumes a 7.1% Rocket Pool annual return (based on the 42% uplift mentioned in part 1).

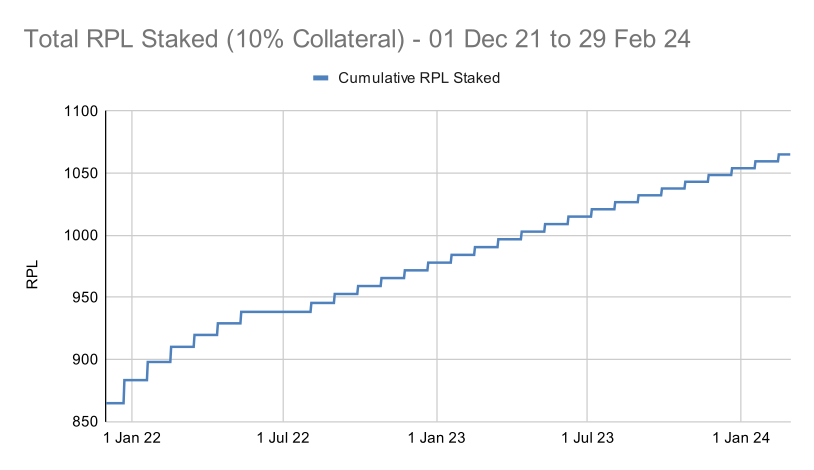

- Assumes the investment was started on 1 Dec 21 and ran to 29 Feb 24 (27 months).

- Costs computed using a gas price of 27 gwei.

Additional assumptions for tests 1 & 2 only

- Payment Dates are every 28 days. The model assumes the data is generated at T and rewards are available to claim at T+1 based on the stake & issuance data at T.

- The total supply and total staked RPL determines the RPL rewards. This information was taken using a Dune query written by a 3rd party.

- Assumes that the RPL collateral is never topped up if it goes below the 10% threshold (the investment amount is fixed on day 1).

- Assumes that a node operator always claims & re-stakes the RPL reward at T+1.

Performance

The total cost to run the test over the time period is calculated, including fees, for the 4 Rocket Pool validators. The total ETH spent is used to benchmark against a vanilla validator.

When calculating returns to compare with a vanilla validator, the start amount is 42.05 ETH for the 10% collateral test and 44 ETH for the 12% collateral test. ~0.45 ETH is set aside at the outset for fees. The 0% collateral (RPL borrowed) start amount is 32 ETH with 0.25 ETH fees.

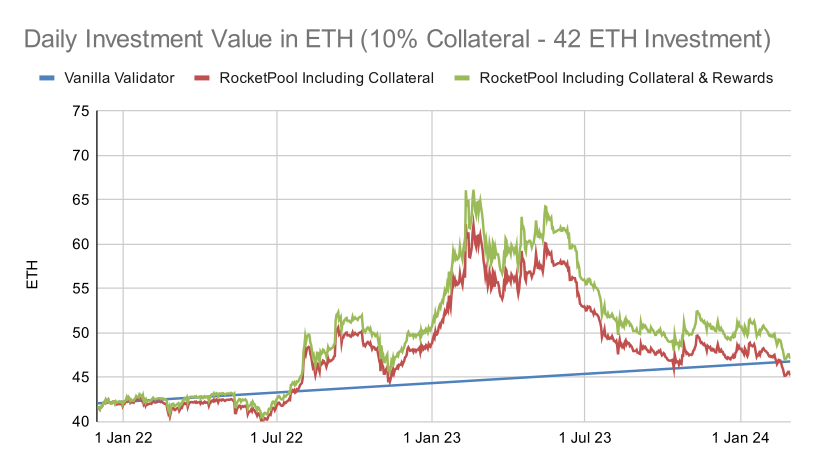

Test 1 - 10% Collateral

| 4 Rocket Pool Validators | ETH |

|---|---|

| Initial Investment | 32 |

| Borrow Amount | 96 |

| RPL Collateral | 9.6 |

| Setup Cost (Node & Minipools) | 0.15663 |

| Claim/Stake Costs (Node level) | 0.19116 |

| Distribute Balance Costs (per Minipool) | 0.07164 |

| Claim From Fee Recipient Costs (Node level) | 0.02826 |

| Total Investment | 42.04769 |

Figure 5

Figure 5

| Change in total ETH | Start | End | Return |

|---|---|---|---|

| Vanilla (Reference) | 42.048 | 46.771 | 11.23% |

| RP Inc. RPL | 42.048 | 45.210 | 7.52% |

| RP Inc. RPL + Rewards | 42.048 | 47.088 | 11.99% |

| RPL | |||

| Price (RPL/ETH) | 0.01110 | 0.00937 | -15.57% |

| Total RPL Tokens | 864.74 | 1065.08 | 23.17% |

| Value in ETH | 9.60 | 9.98 | 4.00% |

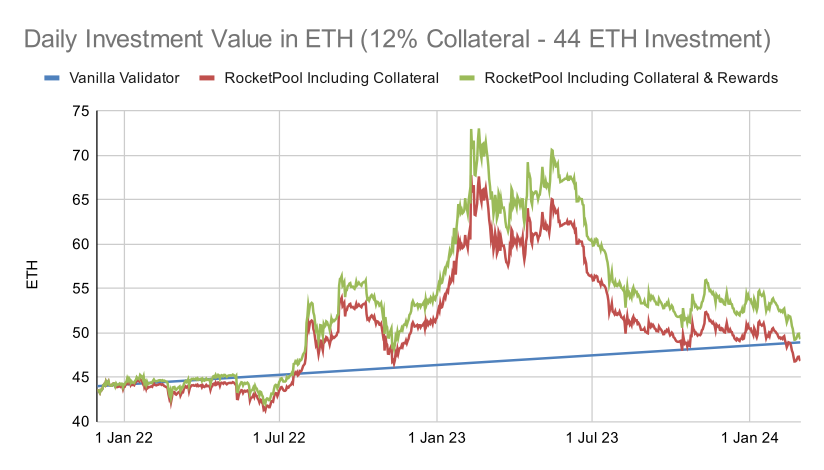

Test 2 - 12% Collateral

| 4 Rocket Pool Validators | ETH |

|---|---|

| Initial Investment | 32 |

| Borrow Amount | 96 |

| RPL Collateral | 11.52 |

| Setup Cost (Node & Minipools) | 0.15663 |

| Claim/Stake Costs (Node level) | 0.20532 |

| Distribute Balance Costs (per Minipool) | 0.07164 |

| Claim From Fee Recipient Costs (Node level) | 0.02826 |

| Total Investment | 43.98185 |

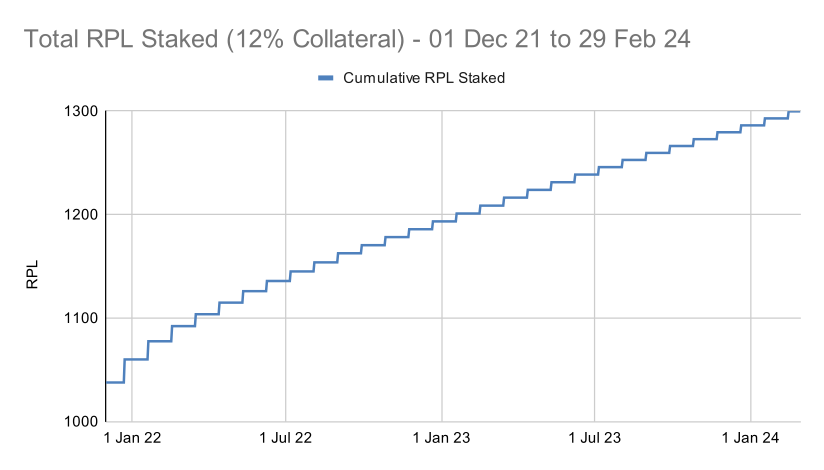

Figure 6

Figure 6

| Change in total ETH | Start | End | Return |

|---|---|---|---|

| Vanilla (Reference) | 43.982 | 48.922 | 11.23% |

| RP Inc. RPL | 43.982 | 46.831 | 6.48% |

| RP Inc. RPL + Rewards | 43.982 | 49.287 | 12.06% |

| RPL | |||

| Price (RPL/ETH) | 0.01110 | 0.00937 | -15.57% |

| Total RPL Tokens | 1037.69 | 1299.72 | 25.25% |

| Value in ETH | 11.52 | 12.18 | 5.76% |

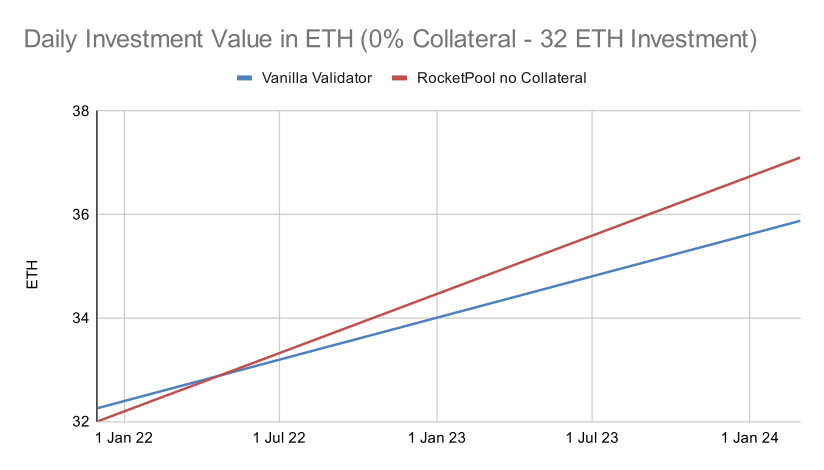

Test 3 - No Collateral (Borrow RPL)

| 4 Rocket Pool Validators | ETH |

|---|---|

| Initial Investment | 32 |

| Borrow Amount | 96 |

| RPL Collateral | 0 |

| Setup Cost (Node & Minipools) | 0.15663 |

| Claim/Stake Costs (Node level) | 0 |

| Distribute Balance Costs (per Minipool) | 0.07164 |

| Claim From Fee Recipient Costs (Node level) | 0.02826 |

| Total Investment | 32.25653 |

Figure 7

Figure 7

| Change in total ETH | Start | End | Return |

|---|---|---|---|

| Vanilla (Reference) | 32.256 | 35.880 | 11.23% |

| RP - No Collateral | 32.256 | 37.104 | 15.03% |

RPL Rewards

In test 1, where the minimum amount of collateral is posted, the ratio falls below 10% on two observation periods in June/July 22.

Figure 8

Figure 8

As a result of the RPL/ETH price movement, a different strategy is to post more than the minimum and create a margin of safety. When test 2 was run with 12% collateral, the ratio was above 10% on every observation and all rewards were captured.

Figure 9

Figure 9

This test requires an additional 2 ETH initially but maximises rewards which results in a higher return over the testing period. All rewards are claimed and re-staked to benefit from additional interest payments. The current value of total RPL holdings are converted into ETH to display on charts and calculate results.

Results

Using the aforementioned assumptions, the returns over the period tested, 1 Dec 21 to 29 Feb 24, are as follows:

| Test | Start (ETH) | End (ETH) | Return |

|---|---|---|---|

| Vanilla (Reference) | 32.256 | 35.880 | 11.23% |

| 1 - 10% Collateral | 42.048 | 47.088 | 11.99% |

| 2 - 12% Collateral | 43.982 | 49.287 | 12.06% |

| 3 - No Collateral | 32.256 | 37.104 | 15.03% |

Borrowing RPL

The 'No Collateral' test (borrow RPL) will be enabled at a protocol level after the Houston upgrade. Rocket Pool will allow a separate owner (withdrawal address) for the RPL collateral. ETH and RPL holders will be able to partner to access additional yield. If the collateral sits with a different entity (who manages RPL rewards independently) the holder of ETH has no collateral risk and after 4.5 months will have paid off the initial setup fees and outperform a vanilla validator.

Sample Node PnL

It is critical to examine how an investment strategy would have performed based on a backtest that simulates past performance. Additionally, analyzing the current performance of live Rocket Pool investments is valuable.

A script was created to read and analyze every transaction on a Rocket Pool node. This script considers the start date of each Minipool, claimed and unclaimed rewards (whether from the smoothing pool or the balances accruing on the Minipools), the net and gross earnings from claim (RPL and ETH), claim and stake (RPL), and distribute balance transactions.

The script makes a major assumption that RPL was purchased on the same day it was sent to the staking contract. It could be extended to allow for specific amounts and dates for RPL purchases.

This approach approximates how the volatile performance of RPL and the protocol fees can affect the profit and loss (PnL). While it is a "best approximation," there is potential for further enhancement to improve its accuracy.

A sample of Nodes was taken from the brilliant RocketScan.io explorer.

Sample Node Results

| Node | Pools | Duration | Pre-RPL (%) | Total Return (%) |

|---|---|---|---|---|

| 1 | 53 | 0.59 | 4.04 | 6.64 |

| 2 | 200 | 1.05 | 6.38 | 11.27 |

| 3 | 72 | 1.39 | 6.61 | 6.64 |

| 4 | 125 | 1.29 | 5.40 | 7.39 |

- Duration is measured in years. The average duration of all Minipools is calculated by taking the time period between the

deposittransaction and the current date and averaging across all Minipools - Pre-RPL return represents all income received net of transaction costs

- Total return includes the performance of the RPL based on the aforementioned assumption of the purchase date

- % change values are annualised to allow for direct comparison

- The script output for each sample node can be found in the Appendix

Sample Node Findings

It is important to note that the analysis is constrained by the impossibility of knowing the exact timing of the node operator's RPL purchase. Consequently, the script assumes that the RPL was purchased on the same day it was staked. While this assumption is almost certainly incorrect, it serves as a “best approximation” and could be enhanced in the future to allow for specific price inputs.

The longer a node operates, the more the initial fixed costs are dispersed, providing more opportunities to propose blocks and capture periods of MEV spikes. Nodes that have been operational for a longer duration consistently show a better pre-RPL return.

Ultimately, the Total Return is always a function of when the RPL was acquired and at what price.

Conclusion

While the commissions for running a Minipool are enticing, the PnL outcome largely depends on the price paid or received for RPL when entering or exiting the investment and whether RPL outperforms ETH, allowing interest to be paid on the collateral without the need to post additional funds.

If you believe in Rocket Pool and RPL as a protocol and token that will continue to attract demand, then the investment warrants further consideration.

Be prepared for significant volatility in RPL prices. If RPL/ETH appreciates over time, a Rocket Pool investment will likely produce a healthy excess return.

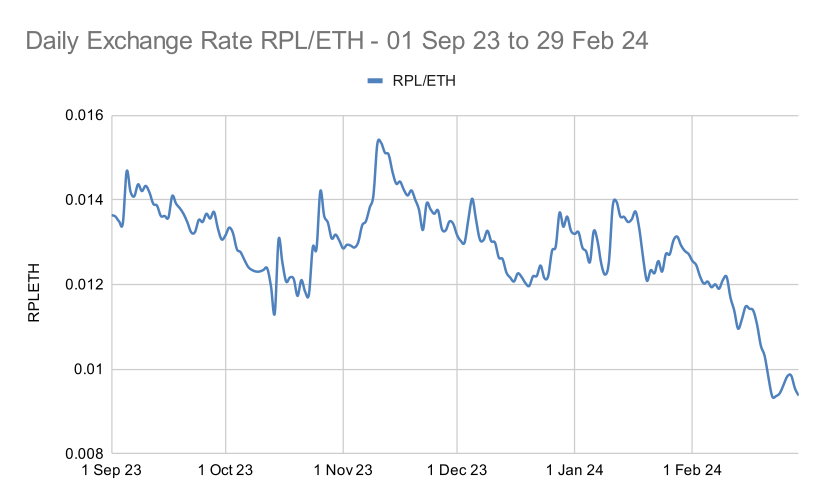

Performance of RPL/ETH over the life of the test and over the past 6 months:

Figure 10

Figure 10

Figure 11

Figure 11

As mentioned in Borrowing RPL, the forthcoming Houston upgrade will allow ETH holders to combine with RPL holders, allowing ETH holders to benefit from additional yield by performing validation for borrowed ETH on behalf of the Deposit Pool and RPL holders to independently post collateral and receive interest.

This is a win-win situation for holders of these assets who want to stay invested in only that asset and benefit from the additional yields provided by the Rocket Pool protocol.

Appendix

Sample Node 1

Found 402 total transactions: 0x52e97b5ca8e850c435f13eacc6aab235661b1a0b

Fee Recipient: 0xf9A1eAC5dF3710D3EE9418d31ABFE4C4AC7e7fe9

---

Processing 53 Deposit Transactions

Processing 53 Stake Transactions

---

Total active days for 53 minipools is 11317 with average 213.528

Deposit Fees 1.514, Stake Fees: 0.214, Registration Fee: 0.006. Total 1.733

---

Total ETH in minipools 5.239 to Public Users 3.379 to Operator 1.860

Total ETH in fee-recipient 0.000 to Public Users 0.000 to Operator 0.000

Operator Unclaimed Total: 1.860

---

Found 0 Claim ETH, Found 0 Claim RPL, 8 Claim & Stake, 224 Distribute Balance transactions

Calculating earnings & Fees...

---

Claim RPL Fees: 0.000

Claim Gross: 0.000, Fees: 0.000, Net: 0.000

Claim & Stake Gross: 3.045, Fees: 0.046, Net: 2.999

Distribute Balance Gross: 7.314, Fees: 0.430, Net: 6.883

ETH Claimed (Gross): 10.359

Claim Fees: 0.476

---

RPL Claimed: 0.000

ETH Claimed (Net): 9.882

ETH Unclaimed: 1.860

Setup Fees: 1.733

Gross ETH 12.218 earned on 53 pools (424.000ETH) for 0.585 years: 4.926%

Net ETH 10.009 earned on 53 pools (424.000ETH) for 0.585 years: 4.035%

---

Processing 35 Direct Stake RPL transactions

Processing 0 Claim RPL transactions

Processing 8 Claim & Stake RPL transactions

---

ETH Equivalent Spent on RPL 189.243.

ETH Equivalent Restaked RPL 5.260.

---

Stake according to contract: 11467 has difference 0 with transaction analysis. Claimed (not staked) RPL: 0

Stake over minimum size: -19.18%.

Average price for 11065.125 is 31.346

Last Price for RPL is 34.960. Profit on Staked Rpl: $39,988.82

Reward RPL 401.402 is worth $14,032.94

Total RPL 11466.527 is worth $400,867.89 with profit $54,021.76

---

Profit on Staked RPL in ETH (Current) 10.221.

Restaked RPL Value in ETH (Current) 3.587.

Total ETH Equivalent Earned from RPL 13.807.

---

Total ETH Deployed: (424.000+189.243) 613.243, Total ETH Earned: (10.009+13.807), 23.816 for 0.585 years: 6.639%

Sample Node 2

Found 2462 total transactions: 0x9a8dc6dcd9fdc7efadbed3803bf3cd208c91d7c1

Fee Recipient: 0x6f44B48C1AC8A2Bf630F93535f4b956F3a1500d3

---

Processing 205 Deposit Transactions

Processing 200 Stake Transactions

---

Total active days for 200 minipools is 76560 with average 382.800

Deposit Fees 7.215, Stake Fees: 1.682, Registration Fee: 0.004. Total 8.901

---

Total ETH in minipools 8.604 to Public Users 5.549 to Operator 3.054

Total ETH in fee-recipient 0.000 to Public Users 0.000 to Operator 0.000

Operator Unclaimed Total: 3.054

---

Found 4 Claim ETH, Found 0 Claim RPL, 6 Claim & Stake, 1700 Distribute Balance transactions

Calculating earnings & Fees...

---

Claim RPL Fees: 0.000

Claim Gross: 8.994, Fees: 0.011, Net: 8.983

Claim & Stake Gross: 26.419, Fees: 0.044, Net: 26.375

Distribute Balance Gross: 80.661, Fees: 3.117, Net: 77.545

ETH Claimed (Gross): 116.074

Claim Fees: 3.172

---

RPL Claimed: 0.000

ETH Claimed (Net): 112.902

ETH Unclaimed: 3.054

Setup Fees: 8.901

Gross ETH 119.128 earned on 200 pools (1600.000ETH) for 1.049 years: 7.099%

Net ETH 107.055 earned on 200 pools (1600.000ETH) for 1.049 years: 6.380%

---

Processing 17 Direct Stake RPL transactions

Processing 0 Claim RPL transactions

Processing 6 Claim & Stake RPL transactions

---

ETH Equivalent Spent on RPL 785.759.

ETH Equivalent Restaked RPL 42.592.

---

Stake according to contract: 61631 has difference 0 with transaction analysis. Claimed (not staked) RPL: 0

Stake over minimum size: 15.10%.

Average price for 59308.646 is 24.788

Last Price for RPL is 34.960. Profit on Staked Rpl: $603,303.59

Reward RPL 2322.296 is worth $81,187.09

Total RPL 61630.942 is worth $2,154,607.65 with profit $684,490.69

---

Profit on Staked RPL in ETH (Current) 154.195.

Restaked RPL Value in ETH (Current) 20.750.

Total ETH Equivalent Earned from RPL 174.945.

---

Total ETH Deployed: (1600.000+785.759) 2385.759, Total ETH Earned: (107.055+174.945), 282.000 for 1.049 years: 11.271%

Sample Node 3

Found 396 total transactions: 0x135fc07e43dfc021d1dc95bbc4a4edf77bcc685c

Fee Recipient: 0xa54023635c884a4814eF28C0ECb26Ef9719971b0

---

Processing 72 Deposit Transactions

Processing 72 Stake Transactions

---

Total active days for 72 minipools is 36474 with average 506.583

Deposit Fees 3.944, Stake Fees: 0.560, Registration Fee: 0.020. Total 4.524

---

Total ETH in minipools 0.693 to Public Users 0.423 to Operator 0.270

Total ETH in fee-recipient 0.000 to Public Users 0.000 to Operator 0.000

Operator Unclaimed Total: 0.270

---

Found 4 Claim ETH, Found 7 Claim RPL, 0 Claim & Stake, 99 Distribute Balance transactions

Calculating earnings & Fees...

---

Claim RPL Fees: 0.130

Claim Gross: 10.982, Fees: 0.027, Net: 10.955

Claim & Stake Gross: 0.000, Fees: 0.000, Net: 0.000

Distribute Balance Gross: 46.609, Fees: 0.368, Net: 46.240

ETH Claimed (Gross): 57.590

Claim Fees: 0.525

---

RPL Claimed: 309.928

ETH Claimed (Net): 57.065

ETH Unclaimed: 0.270

Setup Fees: 4.524

Gross ETH 57.860 earned on 72 pools (576.000ETH) for 1.388 years: 7.238%

Net ETH 52.811 earned on 72 pools (576.000ETH) for 1.388 years: 6.606%

---

Processing 9 Direct Stake RPL transactions

Processing 7 Claim RPL transactions

Processing 0 Claim & Stake RPL transactions

---

ETH Equivalent Spent on RPL 105.084.

ETH Equivalent Restaked RPL 0.000.

---

Stake according to contract: 7817 has difference -369 with transaction analysis. Claimed (not staked) RPL: 369

Stake over minimum size: -54.61%.

Average price for 7817.093 is 31.612

Last Price for RPL is 34.960. Profit on Staked Rpl: $26,166.49

Reward RPL 369.307 is worth $12,910.93

Total RPL 8186.400 is worth $286,195.22 with profit $39,077.42

---

Profit on Staked RPL in ETH (Current) 6.688.

Restaked RPL Value in ETH (Current) 3.300.

Total ETH Equivalent Earned from RPL 9.988.

---

Total ETH Deployed: (576.000+105.084) 681.084, Total ETH Earned: (52.811+9.988), 62.799 for 1.388 years: 6.643%

Sample Node 4

Found 675 total transactions: 0x1de3626d6fc2d7c14af8020b5e8a0c3371d9195d

Fee Recipient: 0xf68e2B1FaB9469ff2177912AD330c019D62E374e

---

Processing 136 Deposit Transactions

Processing 125 Stake Transactions

---

Total active days for 125 minipools is 58838 with average 470.704

Deposit Fees 5.941, Stake Fees: 0.833, Registration Fee: 0.015. Total 6.789

---

Total ETH in minipools 77.330 to Public Users 49.878 to Operator 27.452

Total ETH in fee-recipient 16.913 to Public Users 10.909 to Operator 6.004

Operator Unclaimed Total: 33.456

---

Found 4 Claim ETH, Found 7 Claim RPL, 6 Claim & Stake, 57 Distribute Balance transactions

Calculating earnings & Fees...

Exited (-8ETH) from Total: 0x5e38c5

---

Claim RPL Fees: 0.078

Claim Gross: -8.000, Fees: 0.009, Net: -8.009

Claim & Stake Gross: 0.000, Fees: 0.032, Net: -0.032

Distribute Balance Gross: 51.280, Fees: 0.191, Net: 51.089

ETH Claimed (Gross): 43.280

Claim Fees: 0.310

---

RPL Claimed: 686.746

ETH Claimed (Net): 42.970

ETH Unclaimed: 33.456

Setup Fees: 6.789

Gross ETH 76.736 earned on 125 pools (1000.000ETH) for 1.290 years: 5.950%

Net ETH 69.637 earned on 125 pools (1000.000ETH) for 1.290 years: 5.400%

---

Processing 18 Direct Stake RPL transactions

Processing 7 Claim RPL transactions

Processing 6 Claim & Stake RPL transactions

---

ETH Equivalent Spent on RPL 269.827.

ETH Equivalent Restaked RPL 9.186.

---

Stake according to contract: 21915 has difference -686 with transaction analysis. Claimed (not staked) RPL: 687

Stake over minimum size: -34.51%.

Average price for 21394.034 is 27.529

Last Price for RPL is 34.960. Profit on Staked Rpl: $158,977.68

Reward RPL 1207.364 is worth $42,209.26

Total RPL 22601.398 is worth $790,141.19 with profit $201,186.93

---

Profit on Staked RPL in ETH (Current) 40.632.

Restaked RPL Value in ETH (Current) 10.788.

Total ETH Equivalent Earned from RPL 51.420.

---

Total ETH Deployed: (1000.000+269.827) 1269.827, Total ETH Earned: (69.637+51.420), 121.058 for 1.290 years: 7.393%