Charting Ethereum Issuance

Ethereum 1 secures its chain using a proof of work consensus mechanism, whereas Ethereum 2 uses proof of stake. Both networks create Ether to reward participants, however this increases the total Ether supply. This article looks at the technical changes coming to the Ethereum 1 and Ethereum 2 networks that will result in both short-term and long-term changes to the total supply of Ether.

Issuance and inflation

Issuance is the amount of Ether created by the network minus the amount of Ether destroyed by it.

For example, if the total supply at one point in time is 10 million and a year later it is 12 million it implies an issuance of 2 million.

Inflation is net issuance divided by total supply.

In above example, inflation would be 20%.

Inflation and issuance are usually considered over the time period of a year. Issuance shows the magnitude of the change in total supply, whereas inflation highlights its impact.

Note that Ether is a single currency, ultimately fungible regardless of whether it is on the Ethereum 1 or Ethereum 2 chain. As such, the combined issuance and total supply across both chains is considered when calculating inflation.

Issuance in Ethereum 1

Ethereum 1 issuance is well-known, with a block reward of 2 Ether per block awarded to whoever mines the block. Ethereum 1 blocks are not generated at a set rate, but over time they average out to one block every 14 seconds. This results in issuance of approximately 4.5 million Ether per year.

Ethereum 1 also issues rewards for uncles. Uncles are blocks that missed out on becoming part of the main chain due to another block either being generated or propagated to the network just ahead of them. Uncle rewards are highly network-dependent, but tend to be around 5% of the main issuance, or approximately 250,000 Ether per year.

At the time of writing the total supply of Ether is just under 110 million, with inflation over the past year running at around 4.5%.

The impact of Ethereum 2 phase 0

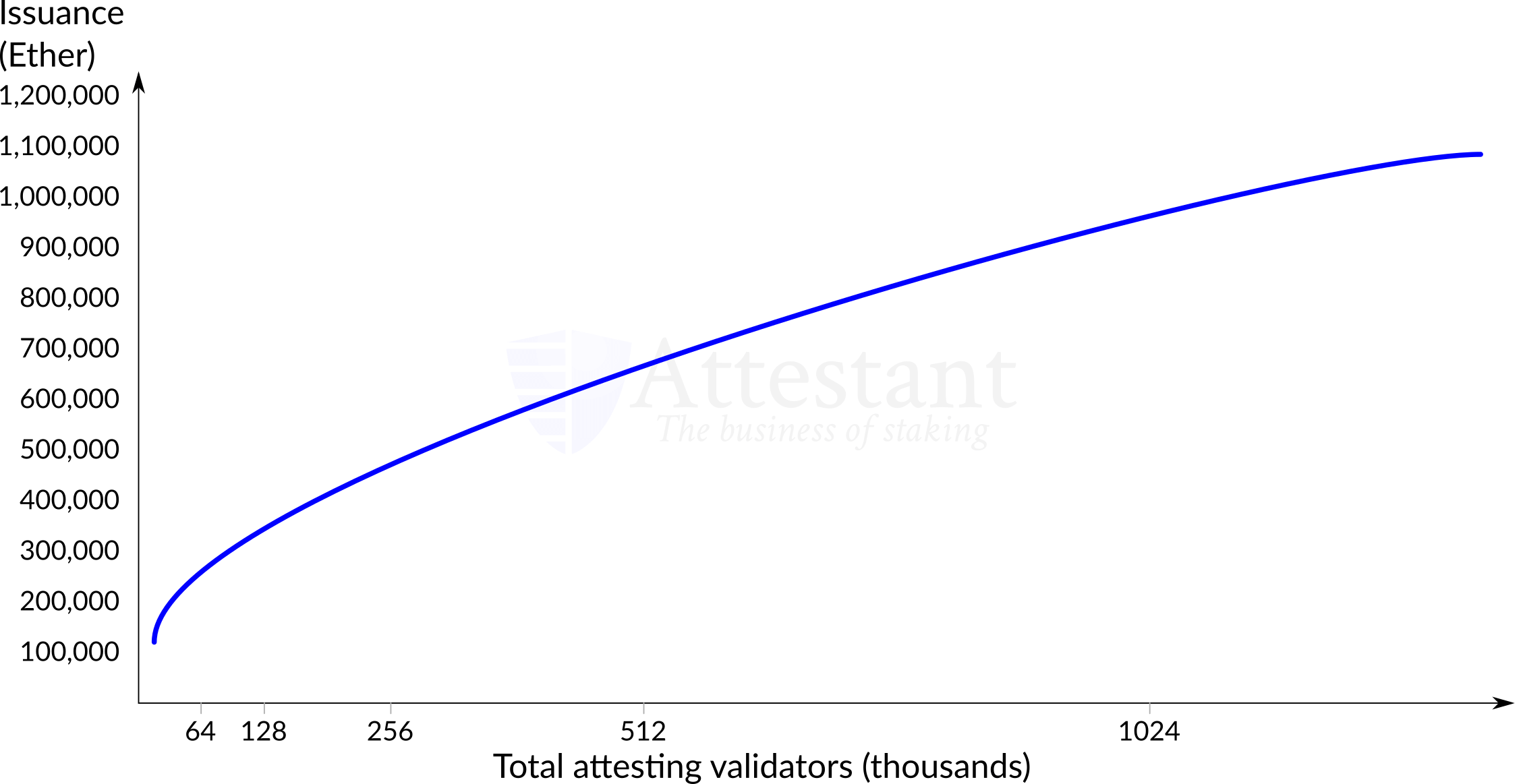

Ethereum 2 brings its own system of issuance. Although blocks are more regular, with (at most) one block being produced in each 12-second slot, the rewards issued for each block are dependent on the total number of validators actively involved with securing the network at the time the block was produced. The graph relating issuance to the number of validators is shown below.

Figure 1: Ethereum 2 issuance

Figure 1: Ethereum 2 issuance

It should be noted that the above chart shows the maximum possible issuance. In reality, some validators will not be active when they should, suffer network issues, etc. which will not only result in the lack of a reward but also result in penalties, both of which will cause a decrease in issuance. As a result, the expectation for Ethereum 2 issuance is around 90% of the value shown.

The impact of EIP-1559

At current, any fees paid by a user when sending a transaction on the Ethereum chain are given to the miner of that block. EIP-1559 is an Ethereum improvement proposal that changes the allocation of fees (amongst other things) such that a large part of these fees are "burned", removing them from the chain entirely and reducing issuance.

Various figures for the amount of fees burned have been considered, however the current proposal is for a burn amount of approximately 80% of the fee1. Transaction fees vary significantly over time (something else that EIP-1559 is attempting to address) but using the current average of 0.1 Ether per block, this would result in a reduction to issuance of around 180,000 Ether.

The impact of the end of mining

There is on-going discussion about merging Ethereum 1 and Ethereum 2. For the purposes of this article, the important point about any future merge is that the Ethereum 1 chain would be secured by Ethereum 2's proof of stake consensus mechanism, the existing proof of work consensus mechanism becoming redundant.

The result of the merge will be a significant drop in issuance, as block and uncle rewards disappear.

The impact of Ethereum 2 phase 2

Phase 2 of the Ethereum 2 rollout introduces transactions. Although the specifics of these transactions have yet to be defined, it will introduce additional actors in the form of state providers. State providers will need to be paid for their work, which implies an increase in issuance. The specific numbers are not yet available, however it is reasonable to expect that state providers will obtain 30% of the reward of a full validator.

Offsetting this increase is the fact that in phase 2 validators will need to carry out more work themselves. This, combined with the fact that by phase 2 it will be simple for validators to stop validating for the first time since the launch of Ethereum 2, is likely to produce a reduction in the number of validators and a consequent reduction in issuance.

However, Ethereum 2 phase 2 is very much the start of the fully functional Ethereum 2 chain. As more applications are deployed on Ethereum 2 there will be more transactions, resulting in a higher amount of Ether burned (thanks to Ethereum 2 adopting EIP-1559) and an ongoing lowering of issuance.

Putting it together

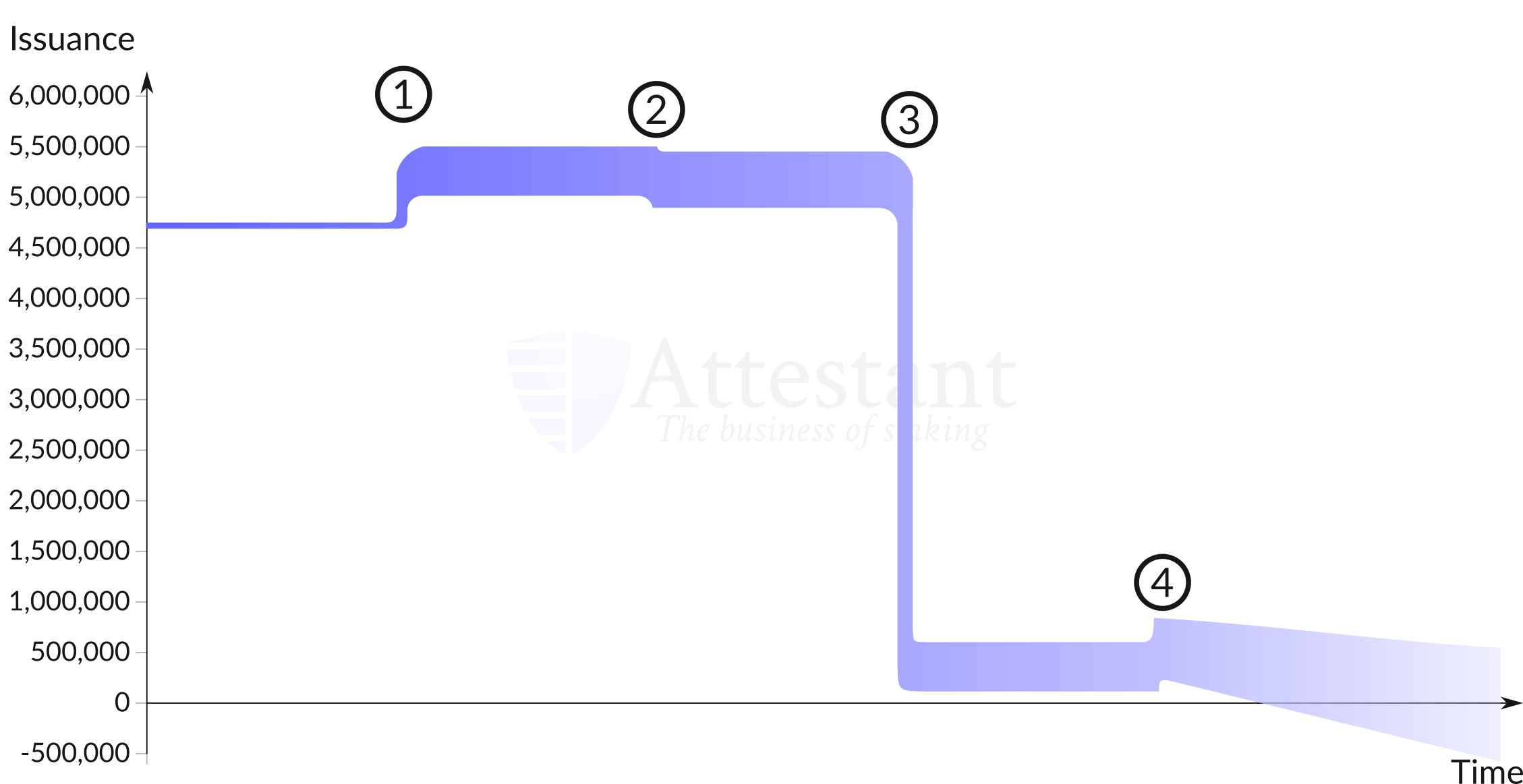

Putting all of these changes together, the following rough timeline of how Ether issuance is expected to change over the next few years emerges:

Figure 2: Issuance over time

Figure 2: Issuance over time

It should be immediately obvious that there are no actual dates on the timeline. Instead, the numbered markers correspond to the following changes:

- Ethereum 2 phase 0;

- EIP-1559;

- The end of mining; and

- Ethereum 2 phase 2.

There is also no guarantee that these items will happen in strict order: it is possible, for example, that the implementation of EIP-1559 comes after the end of mining.

Despite this lack of clarity, looking at the diagram it can be seen that once Ethereum 2 launches, issuance moves from an approximate value to a range. This is because issuance becomes dependent on the number of validators. The range shown is representative of the most likely values given the information available to date.

The move to proof of stake engendered by the launch of Ethereum 2 has an immediate and large impact on issuance, but it is a one-off. In contrast, EIP-1559 has a relatively small initial impact on issuance, but this scales with the number of transactions processed on the Ethereum network. As the number of transactions increases over time issuance will continue to fall, with the possibility that issuance falls below 0 and Ether moves in to the territory of negative inflation for the first time.

The long term expectation is for Ether inflation to lie between 0.5% and -0.5%, whilst retaining and even improving security; this shows that Ethereum has a path forward to secure transactions without incurring large internal and external costs. Although it is not possible for the timeline to be specific, the steps are clear, and point to a strong future for both Ethereum and Ether.

Footnotes

-

In reality a set amount is burned, but this is expected to equate to approximately 80% of the total fee. ↩